Understanding Investment Needs in India

Every working person in India needs two things. Life insurance to protect the family. And investments to build wealth for future goals.

Traditionally, people bought these separately. Term insurance for protection. Mutual funds or fixed deposits for investment.

But managing multiple products takes effort. Tracking different policies. Remembering multiple payment dates. Dealing with various companies.

This is where ULIP enters the picture as a potential solution.

What Is ULIP?

ULIP stands for Unit Linked Insurance Plan. It’s a unique product combining life insurance with market investment in a single policy.

You pay premiums regularly. Part of the money provides life insurance coverage. The remaining amount gets invested in equity, debt, or balanced funds.

So one policy serves two purposes. Death protection for family plus wealth creation through investments.

Popular in India because it offers convenience. One premium payment. One policy document. Two benefits delivered.

How ULIP Works Simply

Understanding ULIP mechanics helps evaluate if it’s the best investment plan in India for you, especially when considering high return investments.

Basic working:

You choose a premium amount and payment frequency. The company deducts charges first. These include mortality charges for insurance, fund management fees, and administration costs.

The remaining money buys units in funds you select. Equity funds for growth, debt funds for stability, or balanced funds for the middle ground.

Unit values change daily based on market performance. Your wealth grows or reduces with market movements.

Lock-in period is 5 years minimum. After that, partial withdrawals are allowed. Or continue till maturity to maximise wealth.

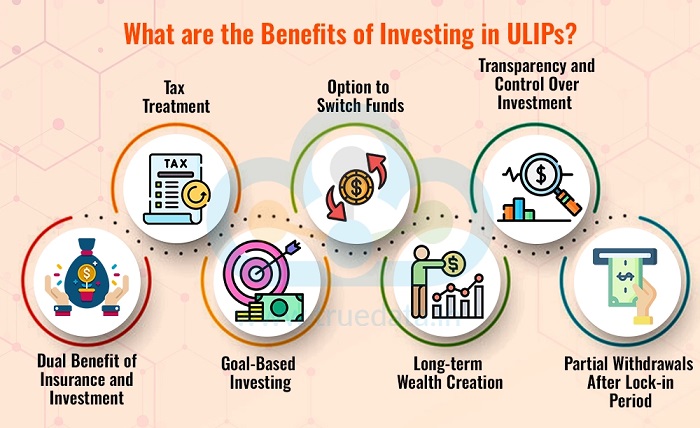

Dual Benefit Advantage

ULIP’s main attraction is getting two benefits from a single product.

Insurance Benefit:

If you die during the policy period, your family receives the sum assured or the fund value, whichever is higher. They’re financially protected when they need it most.

Life cover ensures debts get cleared. Children’s education continues. Spouse has financial support.

Investment Benefit:

Money invested grows through market exposure. Equity funds can deliver 10-12% returns over the long term.

Wealth accumulates for goals like a house down payment, children’s education, and retirement corpus.

Tax-free maturity proceeds add to the benefit. Money received after 5 years has no tax under current rules.

Comparing ULIP with Other Options

Is ULIP truly the best investment plan in India? Let’s compare with alternatives.

ULIP vs Term Insurance + Mutual Funds:

Separate products have lower charges overall. More fund choices in mutual funds. Higher insurance coverage is possible in term insurance.

But ULIP offers convenience. One product to manage. Disciplined investing through regular premiums. Tax-free maturity benefit.

ULIP vs Traditional Insurance:

Traditional insurance gives guaranteed but lower returns of 5-6% only. Safe but limited wealth creation.

ULIP provides higher growth potential through equity exposure. Can deliver 10-12% over long periods. Better wealth building.

ULIP vs Public Provident Fund:

PPF is completely safe. Government guaranteed 7-7.5% returns. No market risk at all.

ULIP has market volatility. Returns not guaranteed. But potential for significantly higher wealth creation. Plus insurance cover included.

Each option has merits. ULIP works for those wanting convenience with market-linked growth.

Who Should Choose ULIP?

ULIP suits a specific type of investor in India.

Good choice if you:

Need life insurance anyway. Why not combine with investment? They are young professionals with a long-term horizon. 15-20 years ahead to absorb market ups and downs.

Want disciplined wealth building. Regular premiums force a savings habit. Prefer tax-efficient investment. Maturity proceeds come tax-free.

Comfortable with market-linked returns. Understand that equity investments fluctuate. Can commit for a minimum 10-15 years. Short-term investors shouldn’t consider.

Looking for convenience. One policy is easier than managing multiple products.

If these match your profile, ULIP deserves serious consideration.

ULIP Investment Strategy

Getting the best returns from ULIP needs a smart strategy.

Smart ULIP approach:

Start young when premiums are cheapest. Time maximises compounding benefits. Choose equity funds for long-term goals. Higher growth potential over 15+ years.

Review fund performance annually. Switch to better-performing funds if needed. Most ULIPs allow 4-5 free switches yearly.

Increase investment through top-ups. When income grows, add to ULIP through additional premiums.

Stay invested for the long term. Don’t withdraw early. Let compounding work magic over decades.

Patience and discipline turn ULIP into a powerful wealth creator.

Tax Benefits of ULIP

ULIP offers attractive tax treatment, making it a tax-efficient option.

Tax advantages:

Premiums paid qualify for Section 80C deduction. Up to 1.5 lakh yearly reduces taxable income.

Maturity amount is completely tax-free. The entire wealth created comes without any tax deduction.

The death benefit to the family is tax-free. No income tax on the sum assured received.

This triple tax benefit adds significant value, especially for people in higher tax brackets.

The Secret to ULIP Returns: Understanding Charges

A major criticism of ULIPs used to be the high initial charges, which severely impacted early returns. However, new-age ULIPs have become much cleaner. When comparing policies, you must dig into the Charge Structure. Look for plans that have a Zero Allocation Charge or that refund allocation charges after the 5-year lock-in period.

- Impact on Wealth: Lower charges mean more of your premium goes directly into buying units, maximising the power of compounding over 15 to 20 years.

- The Expense Ratio: Compare the Fund Management Charges (FMC) across different insurers. Even a 0.5% difference in the annual charge can lead to lakhs of rupees in variation at maturity.

- The Key Comparison: Always check the projected maturity value after all charges are factored in. Don’t just compare the growth potential.

Making the Right Choice

Is ULIP the best investment plan in India? Depends on your specific situation and priorities.

If, after honest evaluation, ULIP fits your financial personality and goals, it can be an excellent wealth creation tool. Market-linked growth, insurance protection, and tax benefits make it a compelling option.

But remember, ULIP needs long-term commitment. Minimum 10-15 years gives the best results. Short-term investors will face disappointing returns after charges.

Evaluate your goals, risk appetite, and discipline level. Then decide if ULIP deserves a place in your investment portfolio as the best investment plan in India for your unique situation.